In his first appearance at AmCham, Managing Director Akin Dada addressed the members on the Euro zone crisis and its implications for Cameroon. Before launching his presentation Mr. Dada disclaimed being an expert but encouraged questions even though he believes no single person can give a universally acceptable answer. Here’s the gist: the defining area is the EU European union in which the euro zone is used as currency of 332 million people. Initially the euro was adopted as a way to boost Europe’s flagging productivity. The EU is made up of 27 countries who have adopted the EURO following the signing of the Maastricht treaty as a European means for greater economic and monetary cooperation.

In his first appearance at AmCham, Managing Director Akin Dada addressed the members on the Euro zone crisis and its implications for Cameroon. Before launching his presentation Mr. Dada disclaimed being an expert but encouraged questions even though he believes no single person can give a universally acceptable answer. Here’s the gist: the defining area is the EU European union in which the euro zone is used as currency of 332 million people. Initially the euro was adopted as a way to boost Europe’s flagging productivity. The EU is made up of 27 countries who have adopted the EURO following the signing of the Maastricht treaty as a European means for greater economic and monetary cooperation.

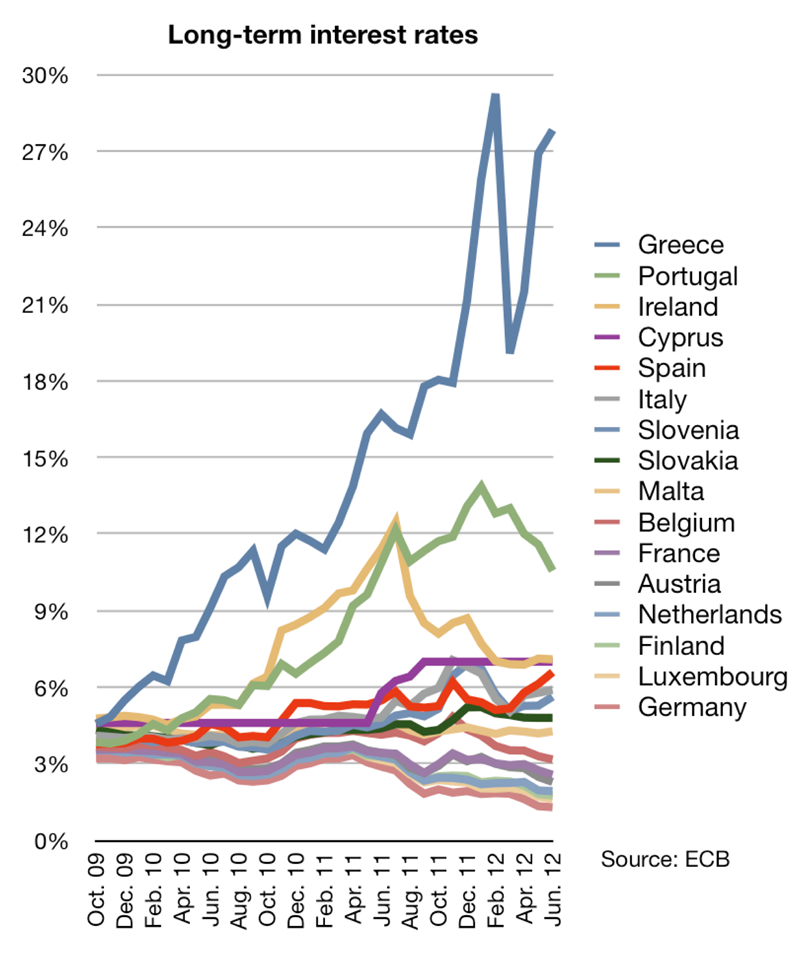

Thus, the one size fits all currency was born. Criteria to qualify for the euro included a budget deficit of less than 3% of GDP and a debt ratio of less than 60%. While countries scrambled to meet the criteria, today 14 of the 27 countries exceed debt to GDP by 66%. The inherent danger with rising levels of debt is the unwelcome interference by the government who in turn exposes the banks to their own debt whose relationship to financial institutions, a primary source of lending, is inextricably linked.Let’s examine the GIIPS (commonly referred to as PIGS) case study. Greece tips the scale with a structural deficit by borrowing to build infrastructure with the hopes that a ROI would appear in the short term, but tax evasion compounded the problem.

Ireland’s large real estate exposure in the first year after adopting the euro was suspect in the bubble bust and having borrowed at 24%  proved to be a case of biting off more than they could chew according to Mr. Dada. Italy the 4th largest economy of the EU was overridden with public debt. Spain simply lost competitiveness backed by increases in housing and family indebtedness. Overall, public debt, low growth, bank bailouts even demographics as in the aging pensioners who rely totally on government support all contributed to the crisis.

proved to be a case of biting off more than they could chew according to Mr. Dada. Italy the 4th largest economy of the EU was overridden with public debt. Spain simply lost competitiveness backed by increases in housing and family indebtedness. Overall, public debt, low growth, bank bailouts even demographics as in the aging pensioners who rely totally on government support all contributed to the crisis.

“Skeptics about the euro insisted that its members did not constitute an optimal currency area and foresaw the drawbacks of a one size fit all monetary policy, particularly without a corresponding fiscal policy. What are the implications for Cameroon? Since Europe is the base from which come remittances back “home”, job cuts and reduced income could have an effect. Cameroon’s ample liquidity helps stave off collapse. However, business owners should ask who Is their supplier, how long will they be around and how much longer can France defend the cfa.

Reluctance to lend will spill over to euro zone therefore must reduce risk assets in order to survive.